TRADEHOLD’S SA BUSINESS PRODUCES EXCELLENT RESULTS TO DEFY COVID-19

Tradehold’s South African business, the Collins Group, delivered outstanding results in the six months to end August, achieving a net profit of £3.3m. As a result, Tradehold has declared its first interim dividend ever.

The property group reports its results in pound sterling as most of its subsidiaries conduct their operations in that currency.

In addition to Collins, Tradehold also owns the Moorgarth property group and 90% of the Boutique Workplace Company, both in the UK, as well as a portfolio of properties in Namibia. Of its £807m in assets, 49.6% are in South Africa, 42,3% in the UK and the balance in neighbouring countries in Southern Africa.

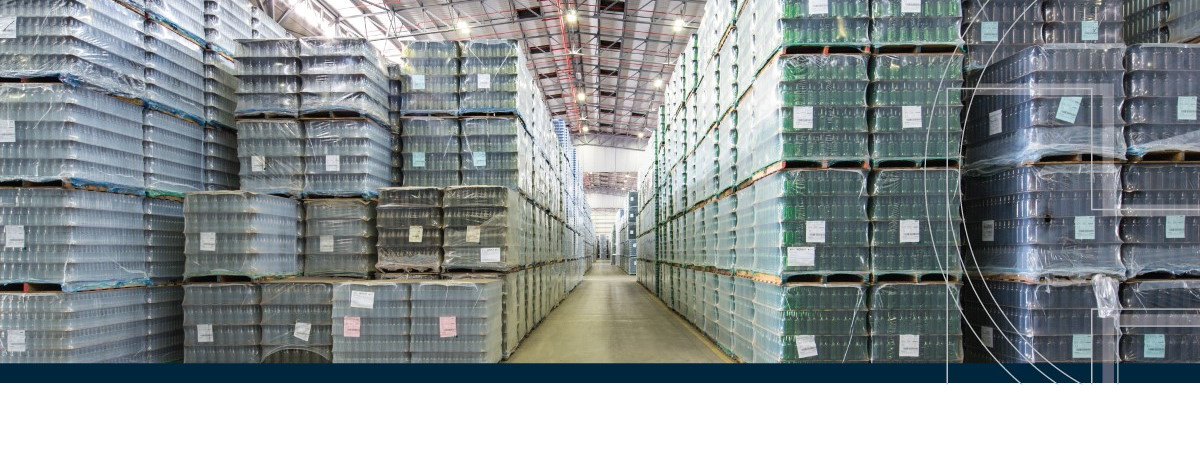

Despite highly disruptive market conditions, Collins achieved its pre-Covid budget by collecting 90% of all rent due. This was despite granting remissions to tenants totalling R30m. It was able to keep vacancies to 1.78% of gross lettable area of 1.5m square metres. On average leases still have close to seven years to run.

Joint Tradehold CEO Friedrich Esterhuyse said: “In Collins’s favour is that more than 80% of the portfolio comprises large industrial and distribution centres leased to predominantly major listed companies”.

Collins, a 74,3% subsidiary, declares a dividend twice a year in terms of its agreement with minority shareholders. Tradehold in turn has declared its allocation – which equates to 30c per ordinary share - to its own shareholders.

In the UK, for the six months to August, Moorgarth endured its most challenging period ever, given the Covid-19 economic fallout, the uncertainty surrounding an orderly Brexit and its considerable exposure to retail. Even so, it still managed to collect 75% of its rental income across the portfolio. At the same time, it has continued to reduce its exposure to retail which now represents 54% of the total property value in the UK, compared with 60% 18 months ago.

In line with property trends in the UK, Moorgarth has reduced the value of its portfolio by £11.8m. This is the main reason for loss of £12.4m for the reporting period.

Boutique, on the other hand, benefited from the growing interest in flexible, fully equipped office space with the added advantage of shorter lease terms. At the end of August, it operated more than 4 400 workstations spread through 31 buildings in greater London, some of which belong to the group. It has also increasingly entered into contracts with third-party landlords to manage their buildings on a profit-sharing basis.

Largely because of the difficult trading conditions in the UK and the devaluation of the rand, revenue fell to £ 34.5m compared to £47.7m a year ago. The group recorded a net loss of £8.7m for the period (2019: loss of £0,4m).

Esterhuyse said the group expected trading conditions to remain unchanged over the second half of the financial year. He did, however, expect results for the full year to show an improvement on the first half.

“We are upgrading the quality of our portfolios, especially in the case of Collins, and have a pipeline of over R900m of acquisitions at attractive yields that include an off-shore portfolio in Western Europe. Since the beginning of 2019 Collins has been disposing of non-core assets and is close to selling the last of the 37 smaller, mainly commercial properties earmarked for this purpose. As part of this process we are also in early negotiations to sell our total Namibian portfolio, ” Esterhuyse said.

ISSUED BY Tradehold Ltd.

DATE ISSUED

12 November 2020

MEDIA ENQUIRIES

Friedrich Esterhuyse, joint CEO, Tradehold

021 928 4800, 083 256 1769